Several factors affect pet insurance quotes:

- Zip code: Pet insurance companies ask for your zip code because the average cost of veterinary care varies from one location to the next. Someone in LA will likely get a higher quote than someone in Indiana, for example.

- Custom terms: You don't have to accept the initial quote that's presented to you. Look for a customization option. For example, once you get a Lemonade pet insurance quote, scroll past the benefits explanation until you reach a series of drop-downs that let you customize the co-insurance, deductible, and maximum payout.

- Pet age and breed: Pet insurance costs more for older pets because they're more likely to get sick or injured. Likewise, it costs more to cover breeds with a history of congenital conditions like hip dysplasia.

We definitely recommend crunching the numbers to see how much money you'll spend on pet insurance over your pet's lifetime, keeping in mind that pet insurance premiums increase each year.

Then, think about your pet's risk factors and your ability to pay for unforeseen emergencies, like if your dog swallows a rock (that was $2,000 back in 2010), your cat swallows yarn ($1,600), or your dog gets the zoomies in the snow and tears his ACL ($3,000). And then there's the cost of trying to diagnose a mystery illness at four different vets ($3,000) only to find out it's malignant cancer and will cost at least $15,000 to treat. I'm proud of my savings account, but it's not that big.

Even the healthiest of pets usually need arthritis medication or a prescription diet to help them age comfortably, and it can get expensive.

On the one hand, you may never need to file a pet insurance claim, but on the other, it can be life-saving. Ultimately, it's up to you to decide how to prepare for unforeseen emergencies.

Learn more: Is Pet Insurance Worth It?

We wouldn't go so far as to call them a scam, but you definitely can lose money on pet wellness plans if you're not careful.

These optional packages allow you to get some money back on preventative vet care, which isn't covered by insurance.

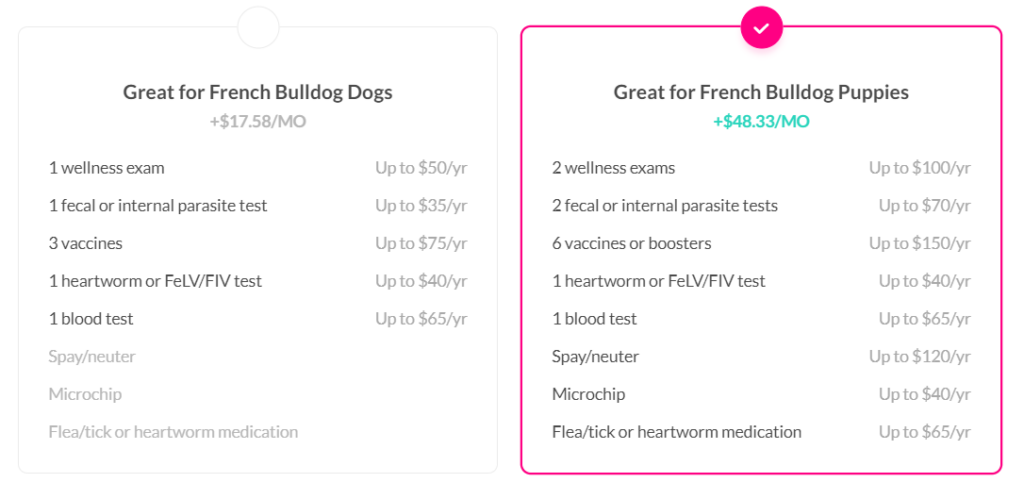

Let's take a look at an example plan for our hypothetical French Bulldog puppy. The highlighted plan on the right offers up to $650 cash-back per year, but there's a cap on each procedure. You'll pay an extra $48.33/mo. for this plan, which comes out to $579.96 per year. Your maximum savings would only be $70.04 per year, and that's assuming you do everything on the list.

Notice that two items—spaying/neutering and microchipping—can only be done once in your pet's lifetime. You'd instantly lose money if you didn't ditch this plan as soon as those procedures were complete. Switching to the plan on the left gives you a maximum benefit of $265 each year, but you'll pay about $211 for it. You'd save up to $54 per year.

In short, pet wellness packages are a good option if you're super organized and willing to track each procedure and benefit to make sure you're not missing out.

Depending on your budget, adding another expense like pet insurance can feel intimidating. But with a little shopping around, you can find a policy that will fit your budget and keep your best friend around for a long time.